🟡BTUSD Daily Market Analysis—June 19, 2025 by Kohinoor Free VIP Signals

- Kohinoor Free VIP Trading Signals

- Jun 19, 2025

- 4 min read

💬 WhatsApp Kohinoor Free VIP Signals https://wa.me/919849640239 for FREE Gold Forex Live Trade Setups & Market Analysis.

Current Market Price

Traders from Dubai 🇦🇪, Singapore 🇸🇬, India 🇮🇳, Australia 🇦🇺, Germany 🇩🇪, and the Netherlands 🇳🇱, welcome to your comprehensive BTUSD daily market analysis. Today, Bitcoin trades at 104,977 USD, and we dive deep into the technicals on both the daily and 4-hour timeframes using powerful indicators like Fibonacci Retracement, EMA, RSI divergence, weekly/daily pivots, Smart Money Concepts (SMC), support & resistance, order blocks, and MACD.

Technical Market Analysis of BTUSD

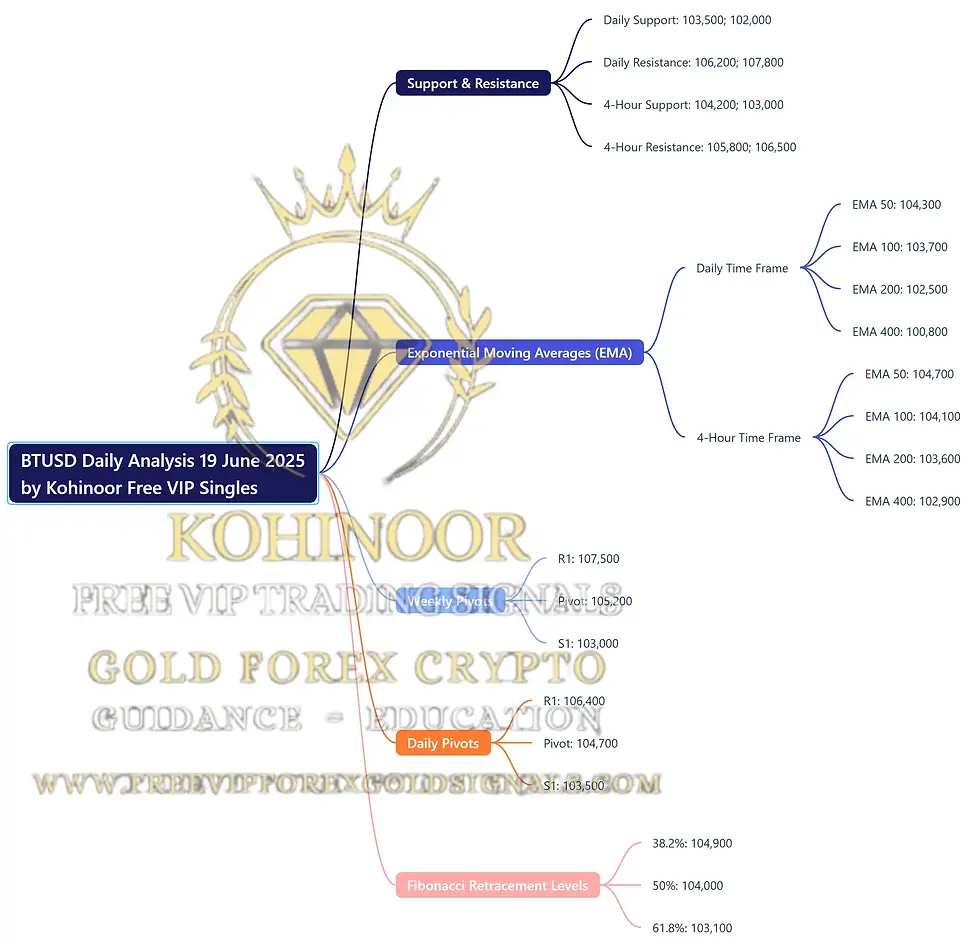

Support & Resistance Levels on Daily & 4-Hour Charts

Daily Support: 103,500 | 102,000

Daily Resistance: 106,200 | 107,800

4-Hour Support: 104,200 | 103,000

4-Hour Resistance: 105,800 | 106,500

These levels are crucial for planning entries, exits, and stop losses.

Fibonacci Retracement Levels — Daily Swing Levels

Using the recent swing high of 107,800 and swing low of 102,000:

38.2% Retracement: 104,900

50% Retracement: 104,000

61.8% Retracement: 103,100

These retracement levels are key areas where price may find support or resistance.

Exponential Moving Averages (EMA) Key Points

Daily Timeframe EMAs:

EMA 50: 104,300

EMA 100: 103,700

EMA 200: 102,500

EMA 400: 100,800

4-Hour Timeframe EMAs:

EMA 50: 104,700

EMA 100: 104,100

EMA 200: 103,600

EMA 400: 102,900

EMAs are essential to identify trend direction and momentum shifts in the BTUSD market.

A price above these EMA levels generally indicates a bullish trend, while price below suggests bearish momentum.

Crossovers between shorter and longer EMAs (e.g., EMA 50 crossing EMA 200) can signal potential trend reversals or continuation.

RSI Divergence

On the 4-hour chart, RSI shows a bullish divergence signaling potential upside momentum. Watch for RSI crossing above 50 for confirmation of strength.

Order Blocks & Smart Money Concepts (SMC)

Recent order blocks appear around 103,800, indicating institutional buying interest. Price respecting these zones suggests strong demand.

MACD Indicator

MACD on the daily timeframe is nearing a bullish crossover, supporting a potential upward move. The 4-hour MACD histogram confirms short-term bullish momentum with increasing bar heights.

Weekly and Daily Pivot Points

Weekly Pivots:

R1: 107,500

Pivot: 105,200

S1: 103,000

Daily Pivots:

R1: 106,400

Pivot: 104,700

S1: 103,500

Pivot points act as dynamic support and resistance for intraday trading.

Fundamental Analysis & Upcoming USD News Impact 📈

This week, traders should watch for the Federal Reserve's interest rate decision and key inflation data. Strong USD news often triggers volatility in BTUSD as Bitcoin tends to react inversely to USD strength. Stay alert to these events for potential market-moving impacts.

Summary

💡BTUSD Daily Analysis Summary by Kohinoor Free VIP Signals – https://wa.me/919849640239

🥇 FREE Telegram Channel: @Kohinoorfreevipgoldforexsi

Key Levels Recap

Support Levels:

Daily: 103,500 and 102,000

4-Hour: 104,200 and 103,000

Resistance Levels:

Daily: 106,200 and 107,800

4-Hour: 105,800 and 106,500

Exponential Moving Averages (EMA):

Daily EMA 50: 104,300

Daily EMA 100: 103,700

Daily EMA 200: 102,500

Daily EMA 400: 100,800

4-Hour EMA 50: 104,700

4-Hour EMA 100: 104,100

4-Hour EMA 200: 103,600

4-Hour EMA 400: 102,900

Weekly Pivot Points:

R1: 107,500

Pivot: 105,200

S1: 103,000

Daily Pivot Points:

R1: 106,400

Pivot: 104,700

S1: 103,500

Fibonacci Retracement Levels (Daily Swing):

38.2%: 104,900

50%: 104,000

61.8%: 103,100

Frequently Asked Questions (FAQs)

Why is Kohinoor Free VIP Signals the best signal provider? Kohinoor Free VIP Signals offers not only FREE signals but also educational resources, daily market analysis, and ebooks. Explore our education articles & blog and free gold forex trading ebooks for comprehensive trading education.

Which brokers are trusted for Gold Forex Crypto trading? Based on client feedback, we recommend trusted brokers such as:

How do I get free BTUSD trading signals? Join the Kohinoor Free VIP Signals Telegram channel here: https://t.me/Kohinoorfreevipgoldforexsignals to receive free BTUSD and gold forex signals.

What indicators does Kohinoor Free VIP Signals use for analysis? We use advanced indicators like Fibonacci Retracement, EMA, RSI divergence, MACD, Order Blocks, and Smart Money Concepts (SMC) to provide accurate signals.

Can beginners benefit from Kohinoor Free VIP Signals? Yes! We provide free educational content, including Level 1 Forex Trading Educational Videos to help beginners learn and trade confidently.

Is trading BTUSD risky? Trading BTUSD and CFDs carries risks. Always use proper risk management and follow our risk disclosure at Risk Warning.

How often are signals updated? Signals and market analysis are updated daily to reflect the latest market conditions and price movements.

Where can I learn more about Kohinoor Free VIP Signals? Learn more about our services here: About Kohinoor VIP Signals.

Disclaimer

Risk Warning: Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary. Please read and ensure you fully understand our Risk Disclosure. https://www.freevipforexgoldsignals.com/risk-disclaimer. Not Financial Advice. Trade at your own risk. Take Partial Profits, Use Strict Stop Loss, and Proper Risk Management.

Comments