🟡 BTCUSD Daily Market Analysis—September 18, 2025 by Kohinoor Free VIP Signals

- Kohinoor Free VIP Trading Signals

- Sep 18, 2025

- 3 min read

💬 WhatsApp Kohinoor Free VIP Signals here for FREE Gold Forex Live Trade Setups & Market Analysis.

Current Market Overview

As of today, the BTCUSD market is live at $3657 of $117,444 USD. This analysis will delve into the daily and 4-hour time frames, utilizing a variety of technical indicators to provide a comprehensive overview of the current market sentiment.

Technical Analysis

Support and Resistance Levels

Identifying key support and resistance levels is crucial for effective trading.

Daily Time Frame:

Support Levels: $3600, $3550, $3500

Resistance Levels: $3700, $3750, $3800

4-Hour Time Frame:

Support Levels: $3630, $3620, $3610

Resistance Levels: $3670, $3680, $3690

Fibonacci Retracement Levels

Using the Fibonacci retracement tool helps identify potential reversal levels. The daily swing high and low provide the following key levels:

Fibonacci Levels:

23.6%: $3670

38.2%: $3650

61.8%: $3620

Exponential Moving Averages (EMA)

The EMAs provide insight into the trend direction:

Daily Time Frame:

EMA 50: $3625

EMA 100: $3600

EMA 200: $3580

EMA 400: $3555

4-Hour Time Frame:

EMA 50: $3645

EMA 100: $3635

EMA 200: $3625

EMA 400: $3615

RSI Divergence

The Relative Strength Index (RSI) is currently showing divergence, indicating potential reversal signals. The RSI is at 60, suggesting that the market may be overbought.

Order Blocks

Identifying order blocks on the daily chart reveals significant buying zones around $3600, which may act as strong support.

MACD Analysis

The MACD indicator is currently bullish, with the MACD line above the signal line, suggesting upward momentum.

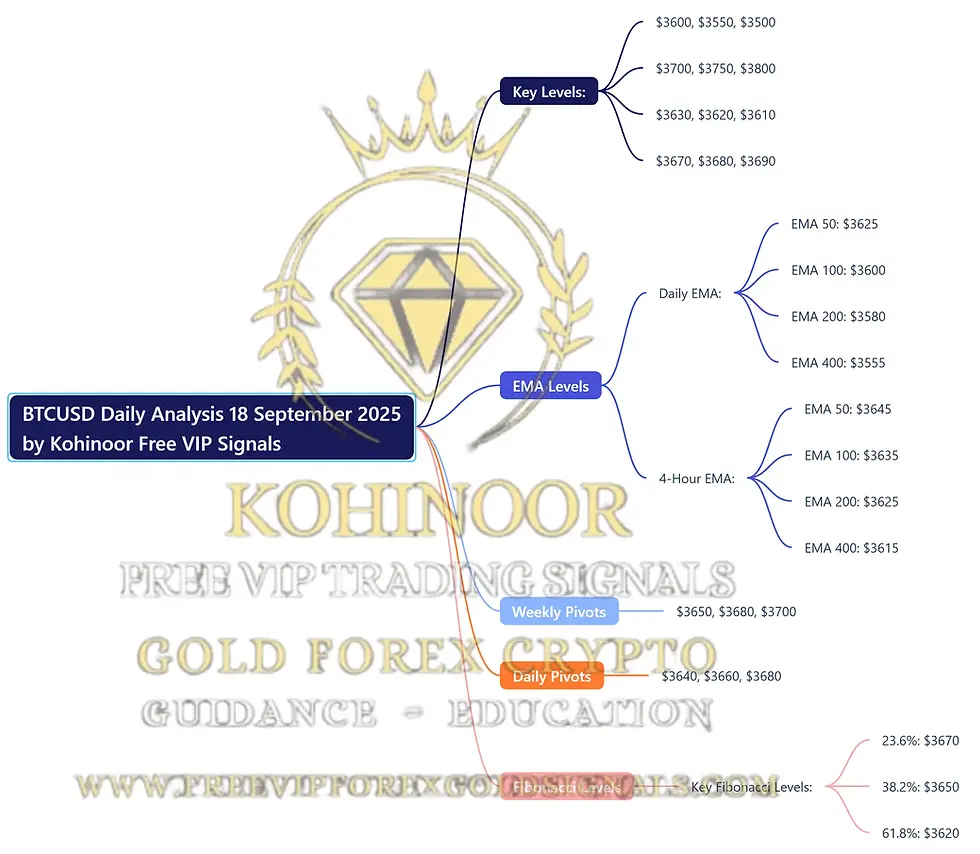

Summary of Key Levels

💡 BTCUSD Daily Analysis Summary by Kohinoor Free VIP Signals – Contact Us join our FREE Telegram Channel: @Kohinoorfreevipgoldforexsignals.

Key Levels:

Daily Support: $3600, $3550, $3500

Daily Resistance: $3700, $3750, $3800

4-Hour Support: $3630, $3620, $3610

4-Hour Resistance: $3670, $3680, $3690

EMA Levels

Daily EMA:

EMA 50: $3625

EMA 100: $3600

EMA 200: $3580

EMA 400: $3555

4-Hour EMA:

EMA 50: $3645

EMA 100: $3635

EMA 200: $3625

EMA 400: $3615

Weekly Pivots

Weekly Pivot Levels: $3650, $3680, $3700

Daily Pivots

Daily Pivot Levels: $3640, $3660, $3680

Fibonacci Levels

Key Fibonacci Levels:

23.6%: $3670

38.2%: $3650

61.8%: $3620

Fundamental Analysis

Upcoming USD news is vital for predicting BTCUSD price movements. Key events to watch for this month include:

Federal Reserve's interest rate decision

Employment data releases

Inflation reports

These factors will significantly influence BTCUSD prices, especially as traders react to changes in monetary policy.

FAQs

Why is Kohinoor Free VIP Signals the best signal provider? Kohinoor Free VIP Signals offers not only FREE signals but also educational resources, daily market analysis, and ebooks. Learn More About Kohinoor Free VIP Signals.

Which brokers are trusted for Gold Forex Crypto trading? Based on client feedback, we recommend brokers like:

What are the benefits of using trading signals? Trading signals provide timely insights and recommendations, helping traders make informed decisions.

How can I manage risk in trading? Implementing strict stop-loss orders and taking partial profits can help manage risk effectively.

What educational resources does Kohinoor Free VIP Signals offer? We provide free educational articles and ebooks to enhance your trading knowledge. Check out our Free Gold Forex Trading Ebooks.

How often are signals updated? Our signals are updated daily to reflect the latest market conditions.

Can beginners benefit from trading signals? Yes, beginners can greatly benefit from trading signals as they provide guidance and reduce the learning curve.

Where can I find more information about Kohinoor Free VIP Signals? Visit our about page for more details.

Disclaimer

Risk Warning: Trading Forex and CFDs carries a high level of risk to your capital, and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary. Please read and ensure you fully understand our Risk Disclosure. Not Financial Advice. Trade at your own risk. Take Partial Profits, Use Strict Stop Loss, and Proper Risk Management.

Comments