🟡 BTCUSD Daily Market Analysis—12 December 2025

- Kohinoor Free VIP Trading Signals

- Dec 12, 2025

- 3 min read

Market Overview

Bitcoin (BTC) continues to be a leading cryptocurrency, attracting traders and investors worldwide. Understanding its market behavior is essential for making informed trading decisions. In this analysis, we will examine both daily and 4-hour timeframes to identify key support and resistance levels, pivot points, and other critical indicators.

Current Price of Bitcoin (BTCUSD)

Current Price: $92,400

Comprehensive Market Analysis

Support & Resistance Levels

Identifying support and resistance levels is crucial for traders looking to capitalize on price movements.

Daily Support Levels:

Level 1: $91,500

Level 2: $90,800

Level 3: $90,000

Daily Resistance Levels:

Level 1: $93,000

Level 2: $93,500

Level 3: $94,200

Fibonacci Retracement Levels

Using the Fibonacci tool, we have identified the following levels based on recent swing highs and lows:

Retracement Levels:

23.6%: $92,800

38.2%: $92,200

61.8%: $91,600

Exponential Moving Averages (EMA)

The EMA helps traders identify the trend direction and potential reversal points:

Daily EMA Levels:

EMA 50: $91,900

EMA 100: $92,100

EMA 200: $92,300

EMA 400: $92,600

4-Hour EMA Levels:

EMA 50: $92,000

EMA 100: $92,200

EMA 200: $92,400

EMA 400: $92,600

RSI Divergence

The Relative Strength Index (RSI) currently indicates divergence, suggesting potential price reversals. Traders should monitor this closely for optimal entry and exit points.

Order Blocks

Order blocks have been identified at the following levels, which could serve as potential reversal points:

Order Block Levels:

$91,500 (Bullish)

$93,000 (Bearish)

MACD Analysis

The MACD indicator is currently showing bullish momentum, indicating a potential upward trend. However, traders should remain vigilant for signs of a correction.

Summary of Key Levels

💡 BTCUSD Daily Analysis Summary by Kohinoor Free VIP Signals – Contact Us

🥇 Join our FREE Telegram Channel: @Kohinoorfreevipgoldforexsignals

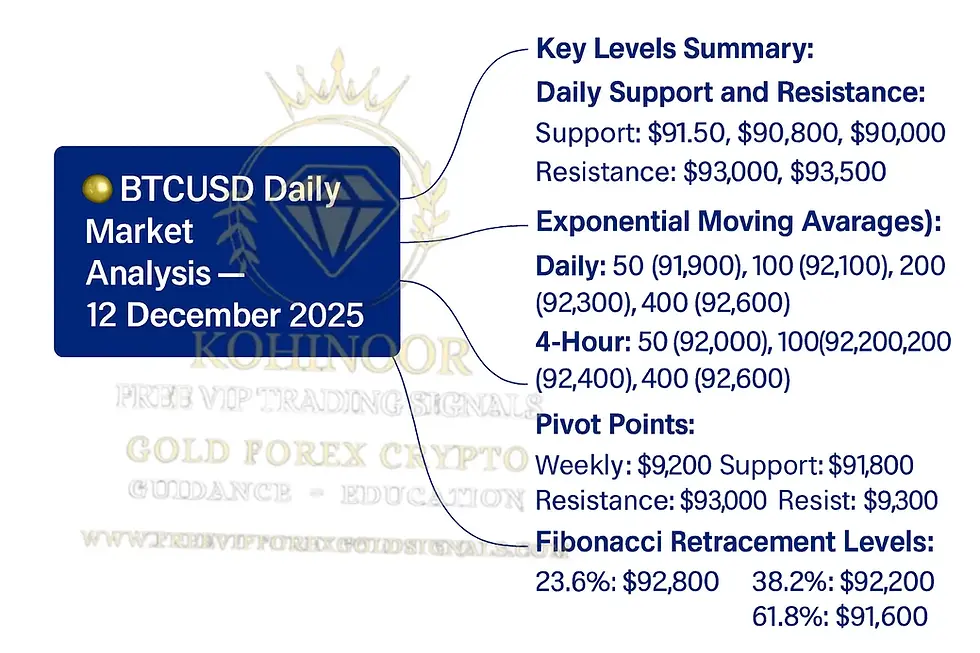

Key Levels Summary:

Daily Support and Resistance:

Support: $91,500, $90,800, $90,000

Resistance: $93,000, $93,500, $94,200

Exponential Moving Averages (EMA):

Daily: 50 (91,900), 100 (92,100), 200 (92,300), 400 (92,600)

4-Hour: 50 (92,000), 100 (92,200), 200 (92,400), 400 (92,600)

Weekly Pivots:

Pivot: $92,200

Support: $91,800

Resistance: $93,200

Daily Pivots:

Pivot: $92,400

Support: $91,600

Resistance: $93,000

Fibonacci Retracement Levels:

23.6%: $92,800

38.2%: $92,200

61.8%: $91,600

Fundamental Analysis and Upcoming USD News

📈 It is crucial to stay updated on upcoming USD news as it can significantly impact the BTCUSD market. Key events to watch include:

Federal Reserve Announcements

US Employment Data

Inflation Reports

These factors can lead to increased volatility in the BTCUSD pair, providing trading opportunities.

Frequently Asked Questions (FAQs)

1. Why is Kohinoor Free VIP Signals the best signal provider?

Kohinoor Free VIP Signals offers not only FREE signals but also educational resources, daily market analysis, and ebooks.

2. Which brokers are trusted for Gold Forex Crypto trading?

Based on client feedback, we recommend the following brokers:

3. What are the benefits of using Bitcoin trading signals?

Bitcoin trading signals help traders make informed decisions by providing entry and exit points based on market analysis.

4. How can I learn more about Forex trading?

You can access our educational resources and articles here.

5. What is the best time to trade Bitcoin?

The best time to trade Bitcoin is during high volatility periods, typically during major market sessions.

6. How do I manage risk while trading Bitcoin?

Using strict stop-loss orders and taking partial profits can help manage risk effectively.

7. What tools do I need for trading Bitcoin?

Essential tools include charting software, economic calendars, and trading platforms.

8. How can I get FREE signals for Bitcoin trading?

You can get FREE signals by joining our community here.

Conclusion

In conclusion, the BTCUSD market is dynamic and offers numerous trading opportunities for those who are informed and prepared. With the current price at $92,400, understanding key support and resistance levels, along with utilizing various technical indicators, is essential for successful trading.

Comments